Rules-Based Money Management: Putting Trend Following to Work

In the realm of financial markets, successful traders often attribute their consistent gains to a rules-based money management system. By implementing such a system, traders can mitigate risks, optimize gains, and maintain discipline in their trading strategies. Among the various approaches to rules-based money management, trend following stands out as a popular and effective method for traders looking to capitalize on market trends and generate profitable returns.

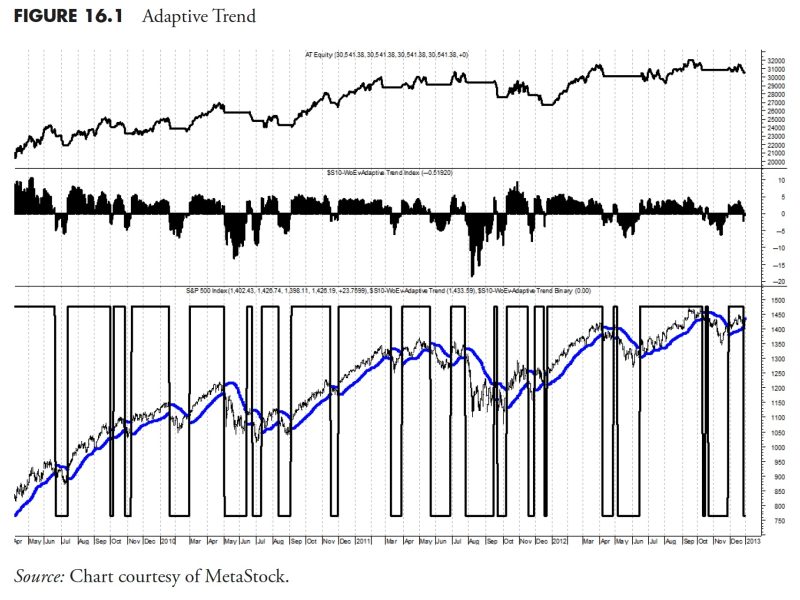

Trend following is based on the principle of riding the wave of market trends, whether they are upward, downward, or sideways. This strategy involves identifying and following the direction of price movements over a specific period, typically relying on technical indicators and trend analysis to guide trading decisions. By aligning trades with the prevailing trend, traders aim to capture substantial gains while minimizing losses during market reversals.

To put trend following to work effectively, traders need to establish a set of rules and guidelines that govern their trading decisions. These rules may include identifying trend signals, setting entry and exit points, determining position sizes, and managing risk levels. By adhering to these predetermined rules, traders can make objective and informed decisions, reduce emotional biases, and maintain consistency in their trading approach.

One key aspect of implementing trend following is the use of technical indicators to confirm and validate market trends. Common indicators such as moving averages, trendlines, and momentum oscillators can help traders identify the strength and direction of trends, enabling them to enter trades at favorable points and stay in positions as long as the trend remains intact. These indicators serve as valuable tools for trend followers to filter out noise and focus on relevant price movements.

Furthermore, risk management plays a crucial role in the success of trend following strategies. Traders must define their risk tolerance, set stop-loss orders to protect against significant losses, and implement position sizing techniques to ensure that no single trade jeopardizes their overall portfolio. By managing risk effectively, traders can preserve capital, withstand market fluctuations, and enhance the longevity of their trading careers.

In conclusion, applying trend following within a rules-based money management framework can significantly improve the trading performance and outcomes of market participants. By identifying and following market trends, utilizing technical indicators, and implementing robust risk management strategies, traders can increase their chances of achieving consistent profits and long-term success in the financial markets. Embracing the principles of discipline, patience, and adaptability is essential for traders to navigate the dynamic nature of markets and capitalize on favorable trading opportunities. By mastering trend following techniques and integrating them into a structured money management approach, traders can elevate their trading efficiency and achieve their financial goals with confidence and resilience.