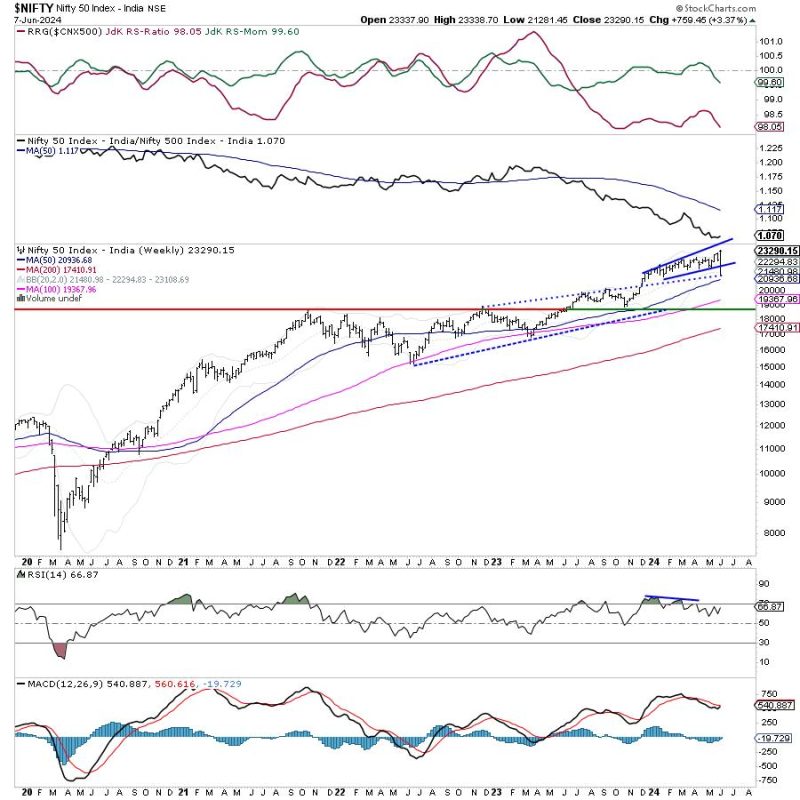

As we look ahead into the upcoming week, despite the recent pullback in the market, there continues to be concern surrounding the overall breadth. The Nifty remains vulnerable to potential retracement, indicating the need for investors to exercise caution and assess their positions carefully.

The recent pullback in the market has resulted in increased volatility and uncertainty among investors. While market participants may view this as a buying opportunity, the underlying breadth of the market remains a concern. A narrow breadth scenario suggests that only a limited number of stocks are driving the market higher, while a broader breadth scenario would indicate a healthier and more sustainable market rally.

In the current context, it is crucial for investors to monitor the breadth of the market closely. An increasing number of stocks participating in the rally would provide more confirmation of the market’s strength and potential sustainability. On the other hand, a continued narrow breadth could signify underlying weakness and increase the likelihood of a retracement in the near future.

Moreover, the Nifty index has been showing signs of vulnerability to potential retracement. While the market has seen periods of bullish momentum, it is essential to recognize the possibility of a pullback or correction. Investors should be prepared for such scenarios and have risk management strategies in place to safeguard their portfolios.

In times of market uncertainty, it is prudent for investors to stay informed and stay vigilant. Conducting thorough research, monitoring market trends, and staying updated on economic indicators can help investors make well-informed decisions. Additionally, diversifying portfolios and setting stop-loss levels can help mitigate risks and protect investments during volatile market conditions.

As we navigate the week ahead, it is essential for investors to remain cautious and proactive in managing their portfolios. By paying attention to market breadth, recognizing potential retracement risks, and implementing effective risk management strategies, investors can position themselves more securely in the ever-changing landscape of the financial markets.