Sector Rotation Model Flashes Warning Signals

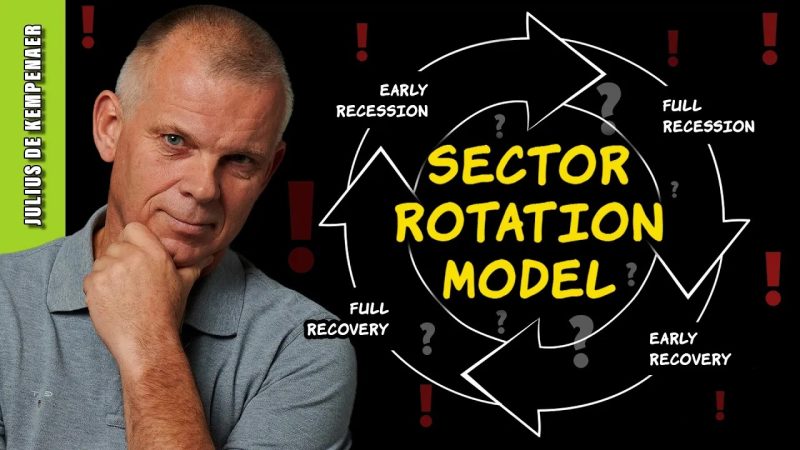

The concept of sector rotation is based on the idea that different sectors of the economy perform better at different stages of the economic cycle. Investors use sector rotation strategies to capitalize on these trends and enhance their investment returns. However, a sector rotation model is currently flashing warning signals, indicating potential changes in market conditions.

The sector rotation model assesses the relative strength of various sectors by analyzing their performance trends. By identifying sectors that are outperforming or underperforming, investors can adjust their exposure to different sectors accordingly. This approach aims to maximize returns by positioning investments in sectors that are expected to perform well in the prevailing economic conditions.

One of the key indicators used in sector rotation models is the relative strength indicator (RSI). RSI measures the magnitude of recent price changes in a sector to determine whether it is overbought or oversold. When RSI values rise above a certain threshold, it suggests that a sector is overbought and may be due for a correction. Conversely, low RSI values indicate that a sector may be oversold and could experience a rebound in the near future.

In recent months, the sector rotation model has been showing warning signals as several sectors exhibit elevated RSI levels. This indicates that these sectors may be overbought and vulnerable to a pullback. Investors who rely on sector rotation strategies may consider reducing their exposure to these sectors or shifting their investments to sectors with more favorable RSI readings.

Moreover, changes in economic conditions can impact sector rotation trends. For example, shifts in interest rates, inflation expectations, or geopolitical events can influence sector performance. In a rapidly changing market environment, investors need to closely monitor economic indicators and adapt their sector rotation strategy accordingly to navigate potential risks and opportunities.

It is essential for investors to exercise caution and maintain a diversified portfolio to mitigate risks associated with sector rotation strategies. While sector rotation can be a useful tool for enhancing returns, it is not without its challenges and uncertainties. By remaining vigilant and staying informed about market developments, investors can make informed decisions to navigate changing sector dynamics and optimize their investment outcomes.