The week ahead seems to bring cautious optimism for the Nifty as it may exhibit a tentative stance. In such uncertain market conditions, investors are advised to look for stocks with strong relative strength to navigate through potential market fluctuations. Identifying such stocks can enhance portfolios and potentially offer more stable returns amidst the volatility.

Relative strength analysis involves comparing the performance of a stock to a benchmark index or other securities within the same industry or sector. Stocks that exhibit strong relative strength tend to outperform their peers during market upswings and show resilience during downturns. This could indicate that these stocks have robust fundamentals, technical strength, or potential catalysts that set them apart from the broader market.

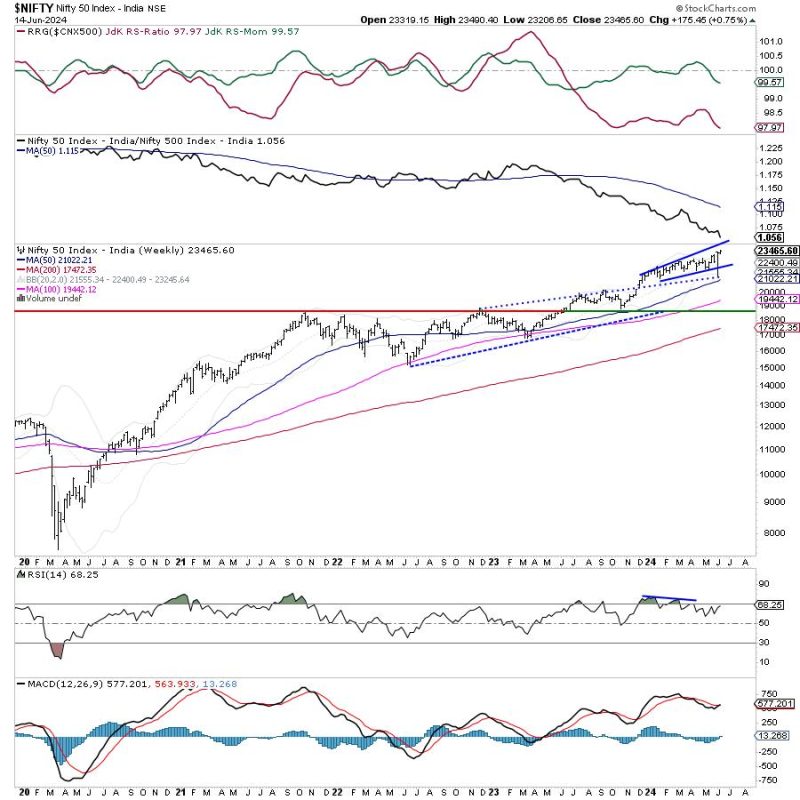

Investors can employ various tools and strategies to identify stocks with strong relative strength. One approach is to analyze price performance trends over different time frames and compare them to relevant benchmarks. This can help identify stocks that have consistently outperformed or shown improving strength compared to the market. Technical indicators such as moving averages, momentum oscillators, and trendlines can also provide insights into the strength and momentum of a stock’s price movement.

Fundamental analysis is another essential tool in identifying stocks with strong relative strength. Evaluating key financial metrics, such as revenue growth, earnings consistency, profitability ratios, and market positioning, can provide a deeper understanding of a company’s underlying strength and growth potential. Companies with strong fundamentals are more likely to sustain relative strength over the long term, making them attractive investment opportunities.

Investors should also consider macroeconomic factors, market trends, and sector-specific dynamics when identifying stocks with strong relative strength. Companies operating in resilient sectors or those that stand to benefit from prevailing market conditions are likely to demonstrate stronger relative strength compared to laggards. Furthermore, staying informed about upcoming events, earnings announcements, product launches, or regulatory changes that could impact stock prices is crucial for making well-informed investment decisions.

In conclusion, during uncertain market conditions, focusing on stocks with strong relative strength can offer investors a way to navigate through volatility and potentially outperform the broader market. By employing a combination of technical analysis, fundamental research, and market insights, investors can identify high-potential stocks that exhibit resilience and growth prospects. Adapting a strategic approach to stock selection and monitoring market dynamics can help investors build a robust and well-performing investment portfolio.