The recent market trends have seen some interesting developments for investors looking to capitalize on potential opportunities. In particular, the NVIDIA Corporation (NVDA), the Russell 2000 index (IWM), and the iShares US Transportation ETF (IYT) have all signaled silver cross buy signals, indicating potential bullish momentum in the stocks.

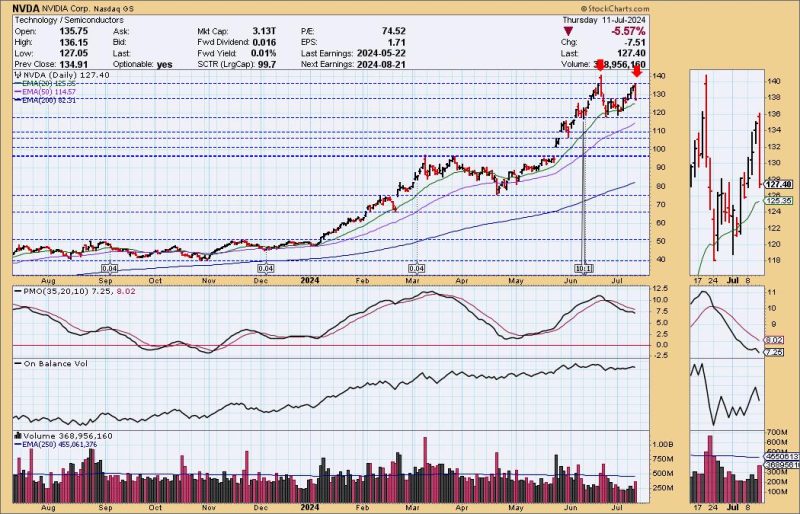

NVIDIA Corporation, a leading global technology company famous for its graphics processing units, has been on the radar of many investors for its strong growth potential. With the recent silver cross buy signal, the stock is likely to attract more attention from traders looking to ride the upward momentum.

Meanwhile, the Russell 2000 index, which represents small-cap stocks in the US, is also showing signs of a silver cross buy signal. This suggests that smaller companies may see an uptick in performance, providing investors with an opportunity to diversify their portfolios and potentially benefit from the projected growth in this segment.

The iShares US Transportation ETF, tracking the performance of transportation stocks in the US, has also received a silver cross buy signal. This could indicate increased economic activity and demand for transportation services, presenting an attractive investment opportunity for those looking to capitalize on the recovery in this sector.

Overall, the silver cross buy signals in NVDA, IWM, and IYT suggest a positive outlook for these stocks and sectors, prompting investors to consider adding them to their portfolios. However, it is crucial for investors to conduct thorough research and analysis before making any investment decisions to ensure they align with their financial goals and risk tolerance.