In the realm of financial markets, where currency fluctuations and stock performances are closely followed, it is imperative for investors to adopt a holistic perspective when analyzing market movements. As highlighted in the article, the Nifty index provides a valuable indicator for monitoring the performance of the Indian stock market. By examining the Nifty index from various angles and dimensions, investors can gain valuable insights that can assist in making informed decisions.

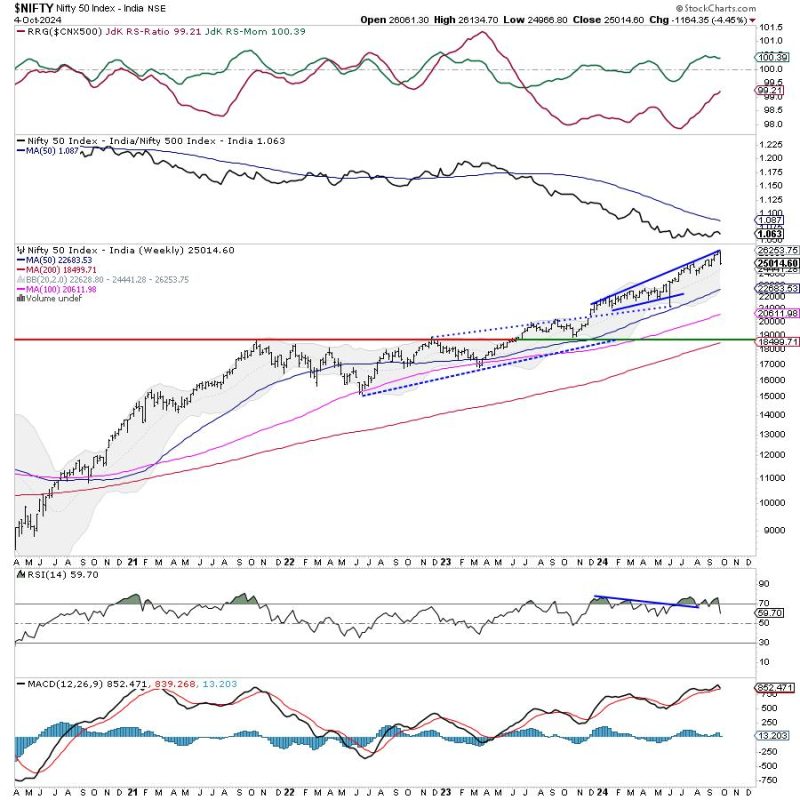

One of the key aspects emphasized in the article is the importance of considering timeframes when evaluating market movements. By looking at the Nifty index over different time periods, such as daily, weekly, and monthly, investors can identify trends and patterns that may not be immediately apparent. This multi-dimensional approach allows investors to better understand the broader market context and avoid making hasty decisions based solely on short-term fluctuations.

Another crucial factor highlighted in the article is the significance of technical analysis in interpreting market movements. Technical indicators, such as moving averages and trend lines, can provide valuable insights into the direction and strength of market movements. By incorporating technical analysis into their decision-making process, investors can complement fundamental analysis and gain a more comprehensive understanding of market dynamics.

Furthermore, the article underscores the importance of considering external factors that can impact market movements. Geopolitical events, economic data releases, and global market trends can all influence the performance of the Nifty index and broader stock market. By staying informed about these external factors and their potential implications, investors can better navigate market volatility and proactively adjust their investment strategies.

In conclusion, a nuanced and multi-dimensional approach is essential for putting market moves into perspective and making informed investment decisions. By examining the Nifty index from different angles, incorporating technical analysis, and considering external factors, investors can gain a more comprehensive understanding of market dynamics and position themselves for long-term success in the financial markets.