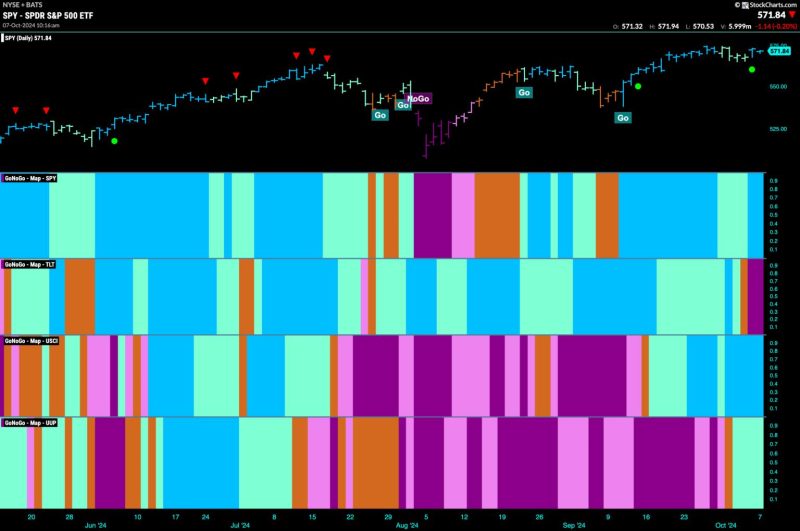

Equities Remain in “Go” Trend and Lean into Energy

The stock market is proving resilient, with equities maintaining a solid upward trajectory as investors embrace the “go” trend. Companies across various sectors are seeing their stock prices soar, reflecting growing confidence in the economy’s recovery. Notably, the energy sector is emerging as a focal point for many investors seeking opportunities for growth and returns.

Energy stocks are having a moment in the spotlight, with many investors leaning into this sector in hopes of capitalizing on the ongoing energy transition and the increased demand for renewable energy solutions. As the world shifts towards a more sustainable future, companies that are involved in clean energy production, such as solar and wind power, are garnering significant interest from both individual and institutional investors.

One key driver behind the recent surge in energy stocks is the global push towards decarbonization and the phasing out of fossil fuels. With governments worldwide committing to ambitious climate goals and the transition to clean energy sources, companies that are at the forefront of this movement stand to benefit immensely from the growing demand for sustainable energy solutions.

In addition to the environmental factors driving the shift towards clean energy, the economic rationale behind investing in energy stocks is also compelling. With the cost of renewable energy technologies continuing to decline and becoming increasingly competitive with traditional fossil fuels, companies that are focused on clean energy production are well-positioned to deliver sustainable returns to investors in the long run.

Moreover, the recent volatility in the oil markets and the ongoing geopolitical tensions in key oil-producing regions have further underscored the need for diversification and resilience in energy investments. By allocating a portion of their portfolio to energy stocks that are aligned with the transition to clean energy, investors can hedge against the risks associated with fossil fuel dependence and position themselves for sustainable growth in the years to come.

As the world continues to embrace the “go” trend in equities, investors are wise to consider the opportunities presented by the energy sector. By leaning into clean energy stocks and companies that are driving the transition to a more sustainable future, investors can not only contribute to a greener planet but also potentially reap significant financial rewards as the energy landscape evolves.

In conclusion, the bullish sentiment surrounding equities and the growing interest in the energy sector indicate an optimistic outlook for investors looking to capitalize on the opportunities presented by the ongoing energy transition. By aligning their investment strategies with the shift towards clean energy solutions, investors can position themselves for long-term success while also playing a role in building a more sustainable future for generations to come.