In the world of finance and stock markets, staying aware of key levels and market movements is essential for successful trading. This article, based on the information from godzillanewz.com, provides insights into the upcoming week’s market dynamics and highlights crucial levels to watch out for.

1. Consolidation Phase:

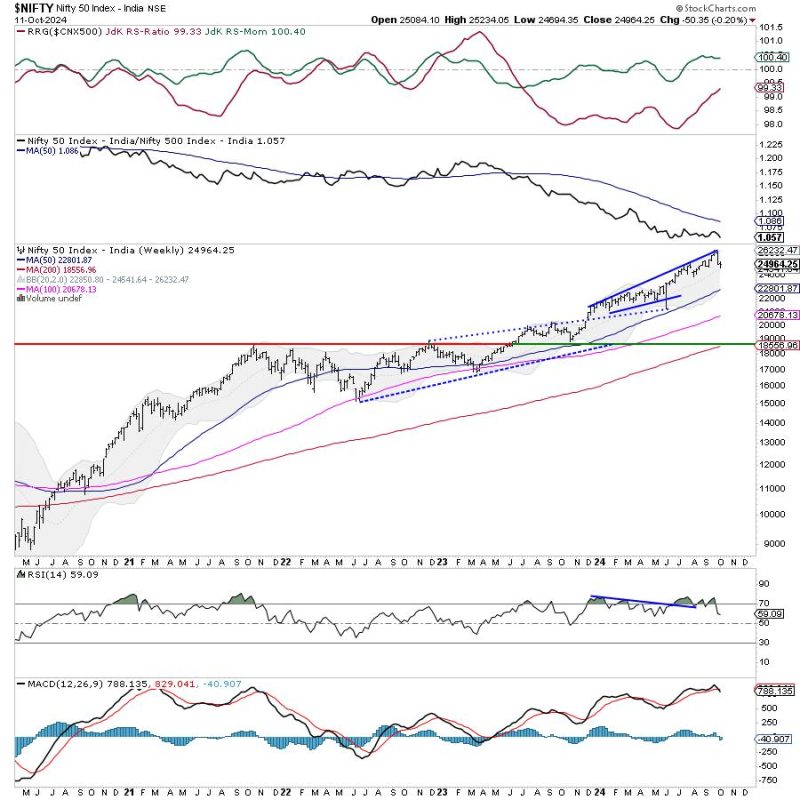

Currently, the Nifty is in a consolidation phase, where it is crucial for traders to exercise caution and closely monitor key support and resistance levels. By keeping a close eye on these levels, traders can better navigate the market uncertainties and make informed decisions.

2. Support Levels:

One of the key levels to keep an eye on is the support level of 14,600. This level holds significance as a breach below it could signal a shift in market sentiment towards a more bearish outlook. Traders should be watchful of how the market behaves around this support level to gauge the strength of the current trend.

3. Resistance Levels:

On the upside, the resistance level of 15,100 is a critical barrier that traders need to watch out for. A breakout above this level could indicate a bullish momentum, potentially leading to further upside movement. Traders should closely monitor market dynamics around this resistance level to anticipate potential market direction.

4. Market Sentiment:

Market sentiment plays a significant role in determining the direction of the market. Traders should pay attention to any changes in sentiment, as it can influence trading decisions and market movements. Factors such as economic data releases, global events, and geopolitical developments can impact market sentiment and drive market fluctuations.

5. Technical Indicators:

Technical analysis tools and indicators can offer valuable insights into market trends and potential price movements. Traders can use tools like moving averages, relative strength index (RSI), and MACD to analyze market trends and identify key trading opportunities. By combining technical analysis with market fundamentals, traders can make more informed trading decisions.

In conclusion, staying vigilant and proactive in monitoring key levels, market sentiment, and technical indicators can help traders navigate the market effectively and make informed trading decisions. By keeping a close watch on crucial levels and being aware of market dynamics, traders can enhance their trading strategies and improve their chances of success in the stock market.