Investing in cutting-edge technology such as artificial intelligence has always presented an exciting opportunity for investors looking to capitalize on the next big innovation. One particular advancement that has been making waves in the AI community is DeepMind’s AlphaFold, a revolutionary technology that leverages deep learning to predict protein folding with remarkable precision. As interest in AlphaFold grows, many investors are eager to explore the possibility of investing in this groundbreaking technology by considering acquiring stock in DeepMind or its parent company, Alphabet Inc.

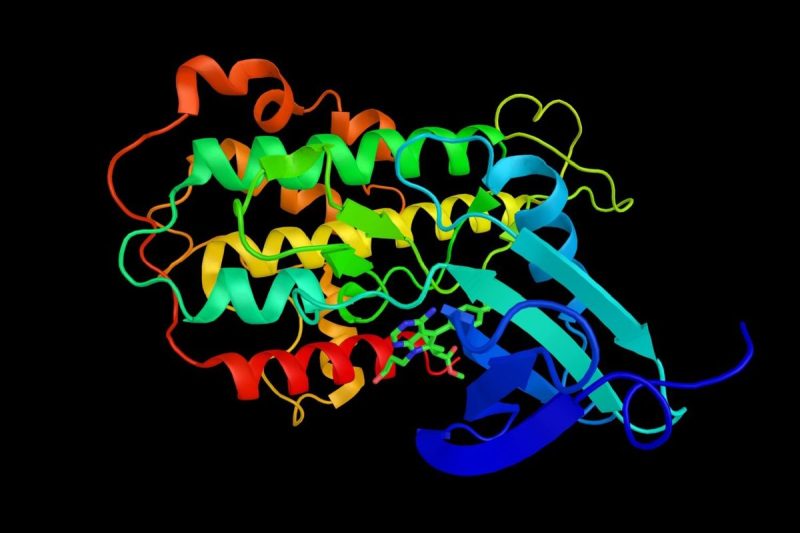

Before diving into how to invest in AlphaFold stock, it’s important to understand the significance of this technology. Protein folding is a complex process that plays a crucial role in various biological functions, and accurate predictions of protein structures can have far-reaching implications in drug development, disease research, and other scientific endeavors. AlphaFold’s ability to predict protein structures with high accuracy has garnered attention from the scientific community and industry experts, leading to collaborations with research institutions and pharmaceutical companies.

For investors interested in gaining exposure to AlphaFold through stock ownership, there are several avenues to consider. As of now, AlphaFold is a product developed by DeepMind, a subsidiary of Alphabet Inc., the parent company of Google. While DeepMind itself is not a publicly-traded company, investors can indirectly invest in AlphaFold by acquiring shares of Alphabet Inc., which owns DeepMind. This allows investors to benefit from Alphabet’s diverse portfolio of technology ventures, including its cutting-edge AI projects such as AlphaFold.

Investing in Alphabet Inc. provides investors with exposure to the potential growth and innovation driven by AlphaFold and other AI initiatives within the company. Alphabet’s strong financial performance and strategic positioning in the technology sector make it an attractive investment option for those looking to capitalize on the advancements in artificial intelligence.

Another way to potentially invest in AlphaFold stock is to monitor any future developments regarding DeepMind’s commercialization strategy for the technology. As AlphaFold gains traction in the scientific community and industry collaborations expand, there may be opportunities for investors to participate in funding rounds or public offerings related to DeepMind or specific projects involving AlphaFold.

In conclusion, investing in AlphaFold stock presents a unique opportunity for investors to support and benefit from the advancements in AI technology, particularly in the exciting field of protein folding prediction. By considering options such as investing in Alphabet Inc. or exploring future investment opportunities related to AlphaFold, investors can potentially capitalize on the growth and innovation brought about by this groundbreaking technology.