As we look ahead to the trading week, there are several key levels and indicators to keep an eye on for the Nifty index. Market analysts have indicated that the Nifty may continue to trade within a range, with potential trending moves expected only if specific levels are breached.

One of the prominent levels to watch is the immediate support level around the 15,650 mark. If the Nifty breaches this support level, it could pave the way for further downside movement. On the flip side, the 15,950 level represents a key resistance point. A decisive breach above this resistance could signal a bullish breakout and potential upward trend.

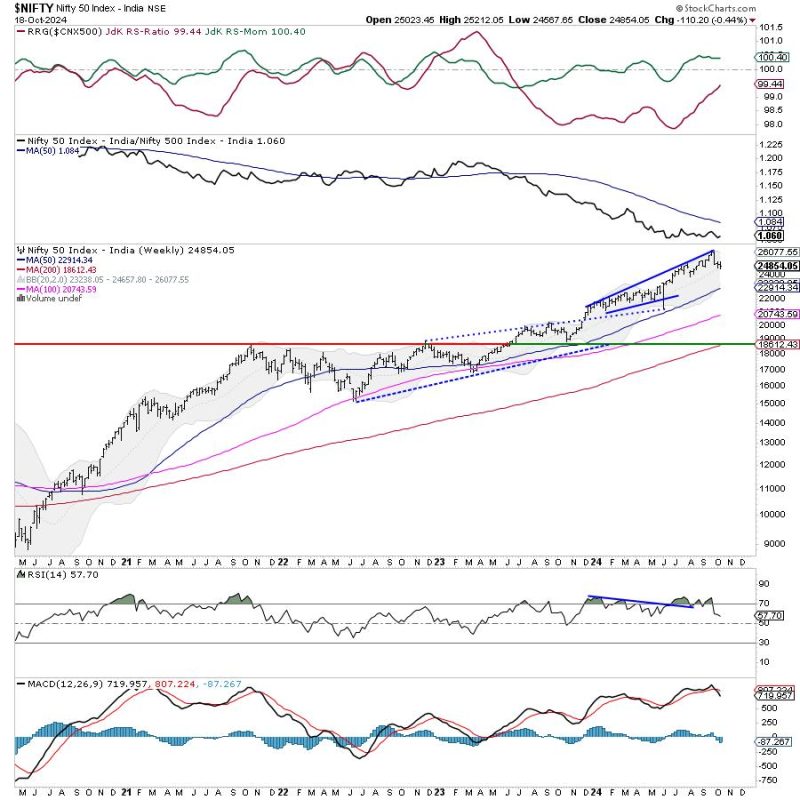

In addition to these levels, the market participants will also closely monitor various technical indicators such as the Relative Strength Index (RSI) and Moving Averages. The RSI provides insights into the momentum of price movements, with readings above 70 indicating overbought conditions and readings below 30 pointing to oversold conditions. Traders will be looking for RSI levels to confirm potential trend reversals or continuations.

Moving averages, such as the 50-day and 200-day moving averages, offer valuable signals about the prevailing trend in the market. Crossovers of these moving averages can provide buy or sell signals, indicating potential shifts in market sentiment and direction.

Overall, the upcoming trading week for the Nifty index appears poised for a range-bound movement, with potential breakout opportunities hinging on the breach of key support and resistance levels. Traders and investors are advised to stay vigilant and responsive to market dynamics, utilizing technical indicators and levels to guide their decision-making processes.