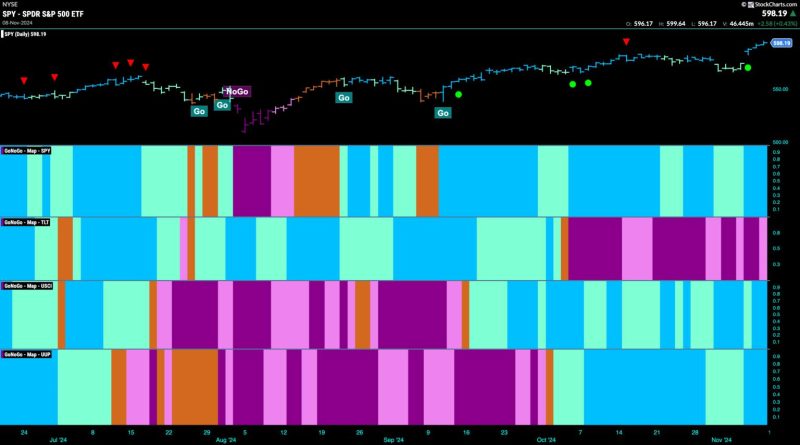

The equity-go trend has been gaining significant strength recently, driven primarily by the financial sector pushing prices higher. As investors continue to flock to equities in search of returns, the financials industry stands out as a key driver of this surge in the equity market.

One of the primary reasons behind the financial sector’s strong performance is the positive outlook on interest rates. With the Federal Reserve signaling a commitment to keeping rates low for the foreseeable future, financial institutions stand to benefit from a supportive interest rate environment. Lower rates reduce borrowing costs for consumers and businesses, which can stimulate economic activity and drive loan demand for financial firms.

Furthermore, the strong performance of the financial sector is closely tied to the overall health of the economy. A recovering economy can boost consumer confidence, leading to increased spending and investment. As economic indicators continue to show signs of improvement, investors are becoming more optimistic about the growth prospects of financial companies.

Another factor contributing to the strength of the equity-go trend is the increasing adoption of digital financial services. Fintech companies are disrupting traditional banking models, offering innovative solutions that cater to the evolving needs of consumers. The growing popularity of online banking, digital payments, and robo-advisors is driving growth in the financial technology sector, attracting investor interest and driving up stock prices.

Additionally, the equity-go trend is also fueled by a wave of consolidation within the financial industry. Mergers and acquisitions are becoming more prevalent as firms seek to scale up and enhance their competitive positions. Consolidation can lead to cost synergies, increased market share, and improved efficiency, all of which can drive stock prices higher and benefit investors.

In conclusion, the equity-go trend is experiencing a surge in strength driven by the financials sector as a result of various factors such as the supportive interest rate environment, the improving economic outlook, the rise of digital financial services, and increased merger and acquisition activity. Investors looking to capitalize on this trend may find opportunities in financial stocks that stand to benefit from these underlying drivers of growth and profitability.