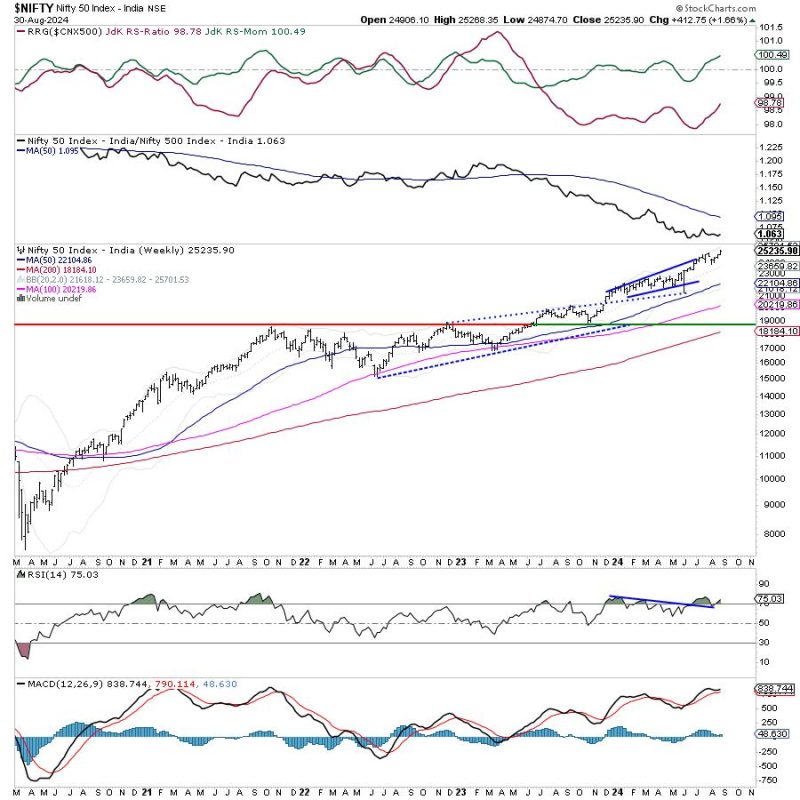

As per the analysis presented on Godzillanewz.com, the outlook for the Nifty remains positive, with the uptrend staying intact. The Relative Rotation Graph (RRG) indicates a distinctly defensive setup, pointing towards potential opportunities for savvy investors.

The RRG is a useful tool for analyzing the relative strength and momentum of various assets or indices. In this case, the defensive setup suggests that certain sectors or stocks that exhibit defensive characteristics may outperform in the near term, even if the overall market is showing signs of weakness.

It is crucial for investors to pay attention to such signals, as they can provide valuable insights into market dynamics and potential opportunities for portfolio adjustments. By understanding the RRG and its implications, investors can make more informed decisions and position their portfolios to take advantage of emerging trends.

While the uptrend in the Nifty remains intact, the defensive setup on the RRG serves as a reminder to remain vigilant and adaptable in a constantly evolving market environment. By staying informed and leveraging tools like the RRG, investors can navigate market volatility more effectively and optimize their investment strategies for long-term success.