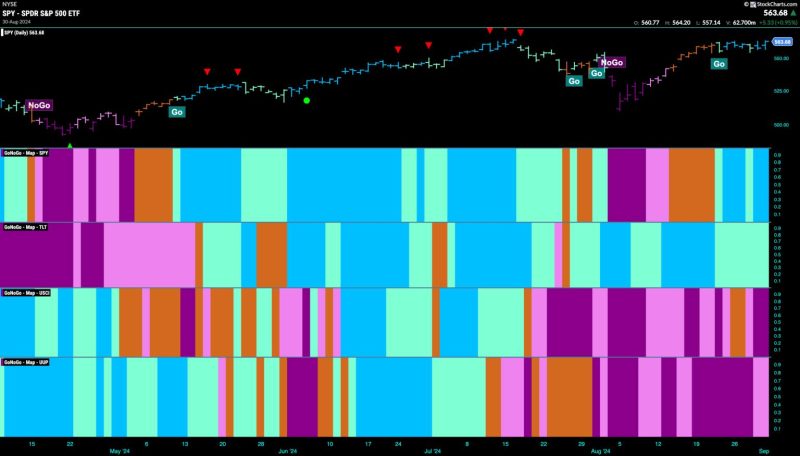

In the fast-paced world of investment and finance, staying ahead of trends is essential. The equity market is particularly dynamic, with stocks constantly shifting based on a multitude of factors. Currently, equities are holding firm in the Go Trend, while industrial stocks are playing a strong defense to navigate the market landscape.

One key aspect driving the steady performance of equities in the Go Trend is the overall positive sentiment towards the stock market. With economic indicators showing signs of growth and stability, investors are confident in the market’s future trajectory. This optimism has contributed to the resilience of equities, with many investors holding onto their positions in anticipation of further gains.

Moreover, the industrial sector’s strong defense can be attributed to several strategic moves made by companies within the industry. Industrial stocks have been focusing on operational efficiency, cost-cutting measures, and diversification of revenue streams to navigate the challenges presented by the current market conditions. By implementing these strategies, industrial companies are better equipped to withstand market fluctuations and economic uncertainties.

Another factor contributing to the strong defense of industrial stocks is the sector’s exposure to infrastructure spending and government contracts. As governments around the world ramp up infrastructure projects to stimulate economic growth, industrial companies are poised to benefit from increased demand for their products and services. This exposure to stable and lucrative government contracts provides a buffer for industrial stocks during periods of market volatility.

Furthermore, the industrial sector’s emphasis on innovation and digital transformation has also played a significant role in bolstering its defense in the market. Companies that have embraced technology and automation are better positioned to adapt to changing market dynamics and consumer preferences. By leveraging data analytics, artificial intelligence, and smart technologies, industrial companies are improving their operational efficiency and competitiveness in the market.

In conclusion, the current market landscape presents both challenges and opportunities for investors in equities and industrial stocks. While equities are holding firm in the Go Trend due to overall positive market sentiment, industrial stocks are playing a strong defense through strategic initiatives, exposure to infrastructure spending, and a focus on innovation. By staying informed and proactive, investors can navigate the market successfully and capitalize on emerging trends in the equity and industrial sectors.