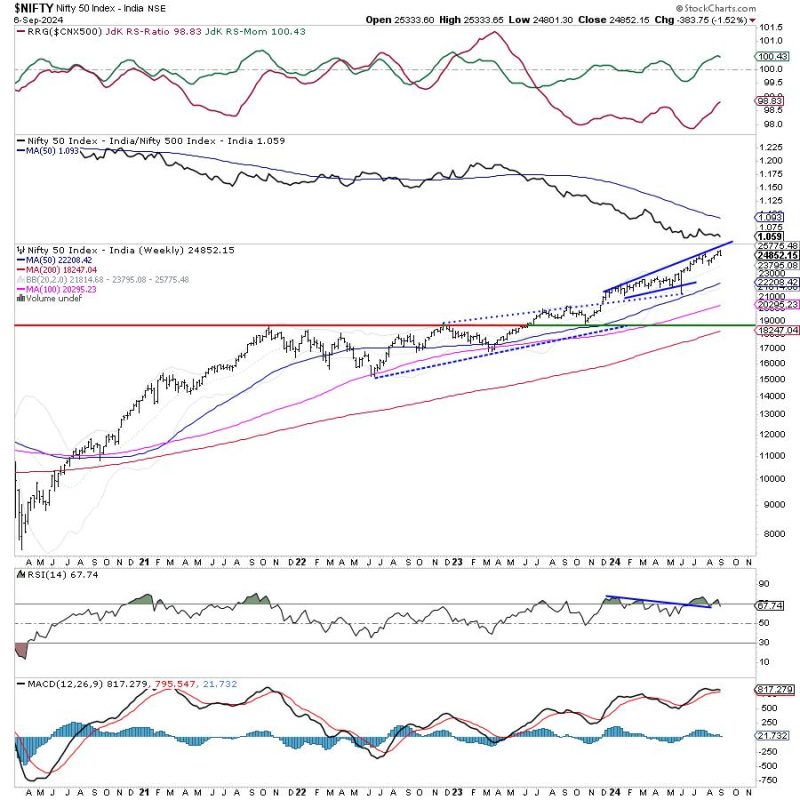

The article discusses the potential disruption of the uptrend in the Nifty index, providing insights and analysis for investors to tread cautiously in the coming week. With a focus on technical indicators and market sentiment, the article guides readers on possible scenarios and strategies to navigate the market volatility effectively.

The article starts by highlighting the early signs of a possible disruption of the Nifty’s uptrend. Technical charts and indicators are scrutinized to suggest a cautious approach for investors. The Nifty’s performance in the recent past is examined, shedding light on the potential risks and challenges ahead.

Moreover, the article delves into the market sentiment and factors contributing to the possible disruption. Geopolitical events, economic indicators, and global trends are analyzed to provide a comprehensive view of the market landscape.

In terms of strategies, the article recommends a defensive stance for investors to mitigate risks and protect their portfolios. Diversification, hedging, and monitoring of key developments are emphasized as essential tactics in such a turbulent market environment.

Furthermore, the article discusses the implications of the possible disruption on different sectors and stocks within the Nifty index. The analysis includes potential winners and losers based on the changing market dynamics, offering valuable insights for investors seeking to realign their portfolios.

In conclusion, the article underscores the importance of vigilance and adaptability in navigating the evolving market conditions. By staying informed, proactive, and flexible, investors can position themselves to weather the storm and capitalize on investment opportunities that arise amidst the disruption of the Nifty’s uptrend.