Sure, here is a well-structured and unique article based on the reference link provided:

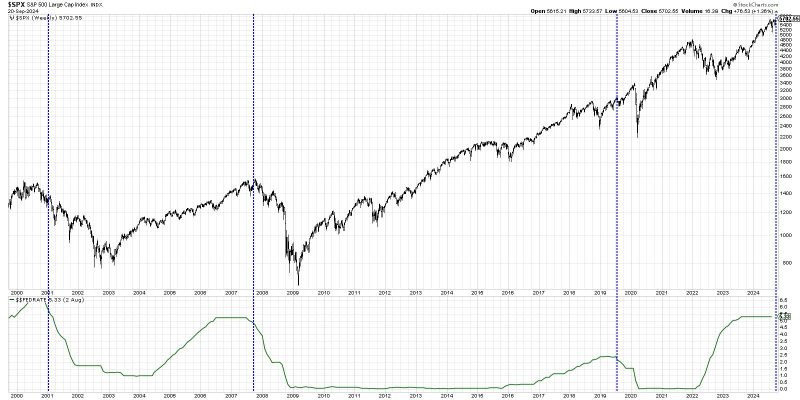

The Effects of Rate Cuts on Stock Performance

Rate cuts by central banks are a tool used to stimulate the economy, but their impact on stock performance is often a subject of debate among investors. While rate cuts are generally seen as a positive development for stocks, the reality is more complex. Understanding the nuances of how rate cuts affect stock performance can help investors make more informed decisions in a volatile market.

Historically, rate cuts have been associated with bullish stock performance. Lower interest rates can make borrowing cheaper for businesses, leading to increased investment and expansion. This can drive corporate profits higher, which in turn can boost stock prices. Additionally, lower interest rates can make stocks more attractive relative to other investments like bonds, leading to increased demand for equities.

However, the relationship between rate cuts and stock performance is not always straightforward. There are several factors that can influence how markets react to rate cuts. Firstly, the market’s expectations play a crucial role. If rate cuts are already priced in by investors, the actual cut may not have the same positive impact on stocks. Conversely, if rate cuts come as a surprise, they can lead to a strong rally in stock prices.

Moreover, the overall economic environment also plays a significant role in determining how rate cuts impact stocks. In times of economic uncertainty or recession, rate cuts may be seen as a signal that central banks are concerned about the economy, which can lead to increased volatility in the markets. On the other hand, in a strong economy, rate cuts may be seen as a supportive measure that can further boost investor confidence.

Another factor to consider is the timing and magnitude of rate cuts. The timing of rate cuts relative to economic conditions can influence their impact on stock performance. Similarly, the magnitude of rate cuts can also affect investor sentiment. Larger rate cuts may signal a more aggressive stance by central banks, which can have a more pronounced impact on stock prices.

In conclusion, while rate cuts are generally associated with bullish stock performance, the relationship between the two is not always straightforward. Investors should consider a range of factors, including market expectations, economic conditions, timing, and magnitude of rate cuts, when assessing how rate cuts may impact stock performance. By staying informed and understanding these nuances, investors can make more informed decisions in a volatile market environment.