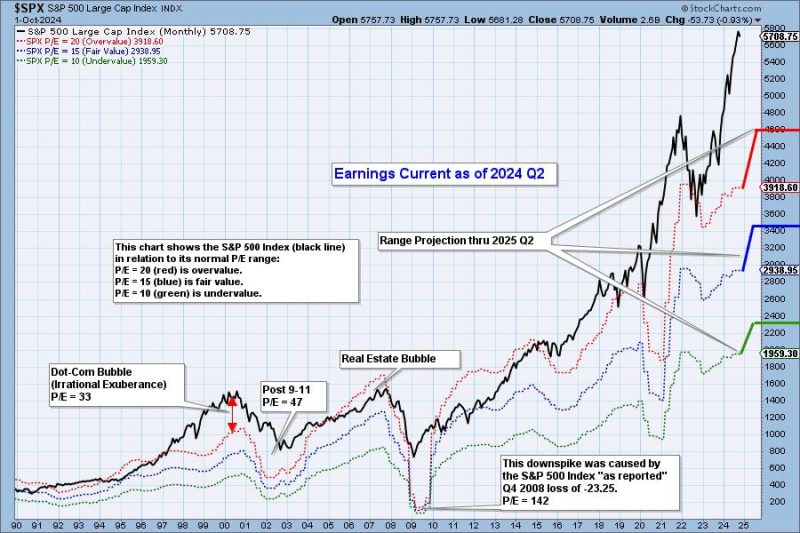

Upon analyzing the market trends for the second quarter of 2024, it becomes evident that there are concerns regarding the overall valuation of the market. While some may argue that the current valuations are justified by strong earnings performance, others remain wary of the potential risks associated with an overvalued market.

One key factor contributing to the perceived overvaluation is the disconnect between stock prices and underlying fundamentals. Despite robust corporate earnings reported in Q2 of 2024, the lofty stock valuations raise questions about sustainability and potential corrections in the future. This disparity between price and value is a cause for concern among investors and analysts alike.

Furthermore, the persistent low-interest rate environment has fueled the rampant rise in asset prices, including stocks. With interest rates at historically low levels, investors are forced to seek higher returns in riskier assets, such as equities. This search for yield has driven stock prices to levels that some believe are detached from economic reality, leading to an overvaluation that may not be sustainable in the long run.

Another factor contributing to the overvaluation debate is the speculative behavior observed in certain segments of the market. The rise of meme stocks, cryptocurrencies, and other speculative investments has added to the frothiness and volatility in the markets. While these assets have captured the attention of retail investors and traders, they also pose risks of sharp corrections and market sell-offs.

In addition to the concerns over valuation, geopolitical uncertainties and macroeconomic factors add to the overall market risk. Geopolitical tensions, trade disputes, inflationary pressures, and potential policy shifts by central banks create an environment of heightened uncertainty. These external factors could trigger market turbulence and exacerbate the risks associated with an overvalued market.

In conclusion, the market remains very overvalued despite strong Q2 earnings in 2024. The disconnect between stock prices and underlying fundamentals, the impact of low-interest rates, speculative behavior, and external uncertainties all contribute to the perception of an overvalued market. Investors are advised to remain cautious, diversify their portfolios, and stay vigilant in monitoring market developments to navigate the challenges of investing in an environment of elevated valuations and heightened risks.