**Technical Analysis Highlights for Nifty**

**Key Support Levels Breached:**

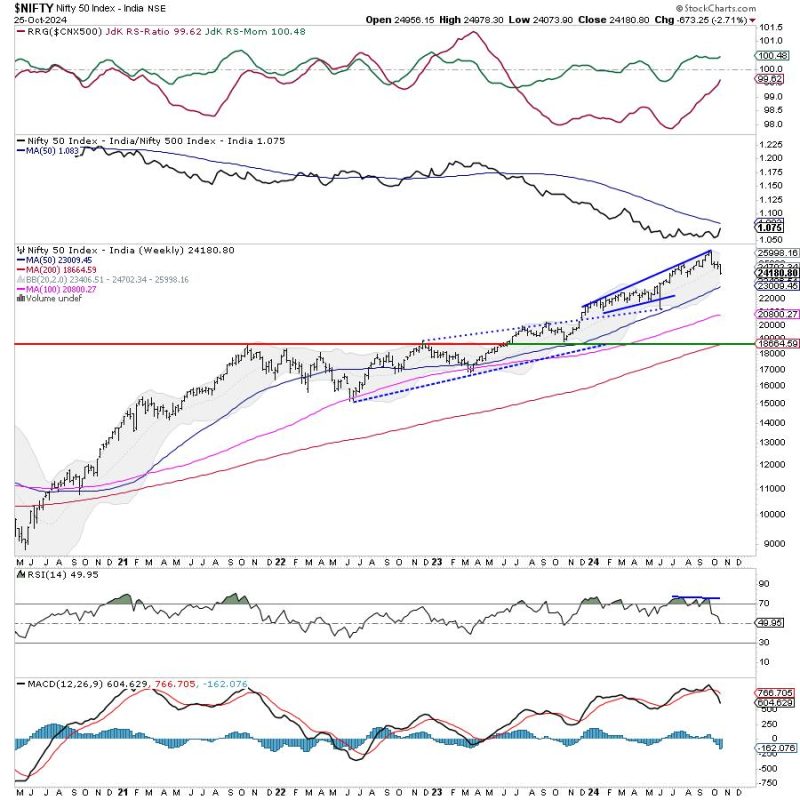

In the past week, the Nifty index experienced a significant downturn, with key support levels being violated. This breach has propelled the index lower, indicating bearish sentiment in the market.

**Resistance Levels Moved Down:**

As a consequence of the breach in support levels, resistance levels have been adjusted lower. This shift reflects the increased selling pressure and challenges faced by the Nifty index to move towards higher levels.

**Volatility on the Rise:**

The recent market movements have been marked by increased volatility. This heightened volatility is a result of the uncertainty and apprehension prevailing in the market, leading to sharp and unpredictable price swings.

**Moving Averages Signal Bearish Trend:**

The moving averages for the Nifty index have taken a negative turn, signaling a bearish trend. The downward crossovers and divergences in these averages indicate a shift in market dynamics towards the downside.

**Importance of Psychological Levels:**

Psychological levels play a crucial role in influencing market sentiments and price actions. With the breach of key psychological levels, such as round figures or significant milestones, the market dynamics are likely to be impacted further.

**Market Sentiment and Investor Behavior:**

The recent developments in the Nifty index have had a noticeable impact on market sentiment. Investors are closely monitoring the unfolding scenarios and adjusting their strategies to navigate through the challenging market conditions.

**Potential Impact on Trading Strategies:**

Given the current market conditions, traders and investors need to reassess their trading strategies. Adopting a cautious approach, setting tight stop-loss levels, and closely monitoring key support and resistance levels can help mitigate risks and capitalize on emerging opportunities.

**Final Thoughts:**

As the Nifty index grapples with breached support levels and downward pressure, it is essential for market participants to remain vigilant and adaptable. By staying informed, utilizing technical analysis tools effectively, and having a well-thought-out trading plan, investors can better navigate through the volatile market environment and make informed decisions to safeguard their investments.