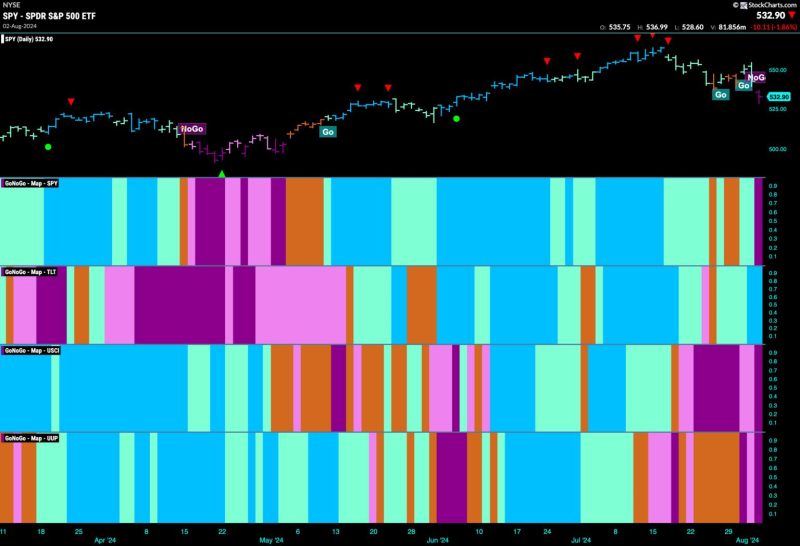

Stocks Get Defensive as Market Index Enters ‘NoGo’ Zone

Amidst the current financial landscape characterized by uncertainty and volatility, investors have resorted to defensive measures in order to safeguard their portfolios. The recent tracking of the market index, as reported by GodzillaNewz.com, indicates that we are currently in what is being referred to as the ‘NoGo’ zone – a period where traditional market dynamics are less predictable, prompting investors to adopt defensive strategies to mitigate potential risks.

One of the key trends observed during this period is the shift towards defensive stocks, which are typically less sensitive to economic cycles and market fluctuations. These stocks tend to perform relatively well during downturns, providing a cushion for investors during times of market stress. Companies operating in sectors such as healthcare, utilities, and consumer staples are often considered defensive, as they offer products and services that are essential regardless of the economic conditions.

Additionally, investors have been turning to dividend-paying stocks as a defensive strategy to generate steady income streams. Dividend stocks, particularly those with a history of consistent dividend payments and strong balance sheets, are viewed as a reliable source of passive income even during turbulent market conditions. By investing in dividend-paying stocks, investors can potentially offset losses from other parts of their portfolio and maintain a stable source of returns.

Another defensive measure that investors are adopting is diversification across asset classes. By spreading investments across a mix of equities, bonds, real estate, and other asset classes, investors can reduce their overall risk exposure and minimize the impact of market volatility on their portfolios. Diversification is a fundamental principle of risk management and can help investors navigate through uncertain market conditions while preserving wealth over the long term.

Moreover, the concept of risk management has gained prominence during this ‘NoGo’ period, with investors paying closer attention to their risk tolerance and adjusting their portfolios accordingly. Utilizing risk management tools such as stop-loss orders, trailing stops, and position sizing techniques can help investors limit potential losses and protect their capital in a volatile market environment.

In conclusion, the current market environment characterized by heightened volatility and uncertainty has prompted investors to adopt defensive strategies to safeguard their portfolios. By focusing on defensive stocks, dividend-paying stocks, diversification, and risk management techniques, investors can navigate through turbulent market conditions and position themselves for long-term success. While the ‘NoGo’ zone may pose challenges, it also presents opportunities for investors to re-evaluate their investment strategies and build resilient portfolios that can withstand market fluctuations.