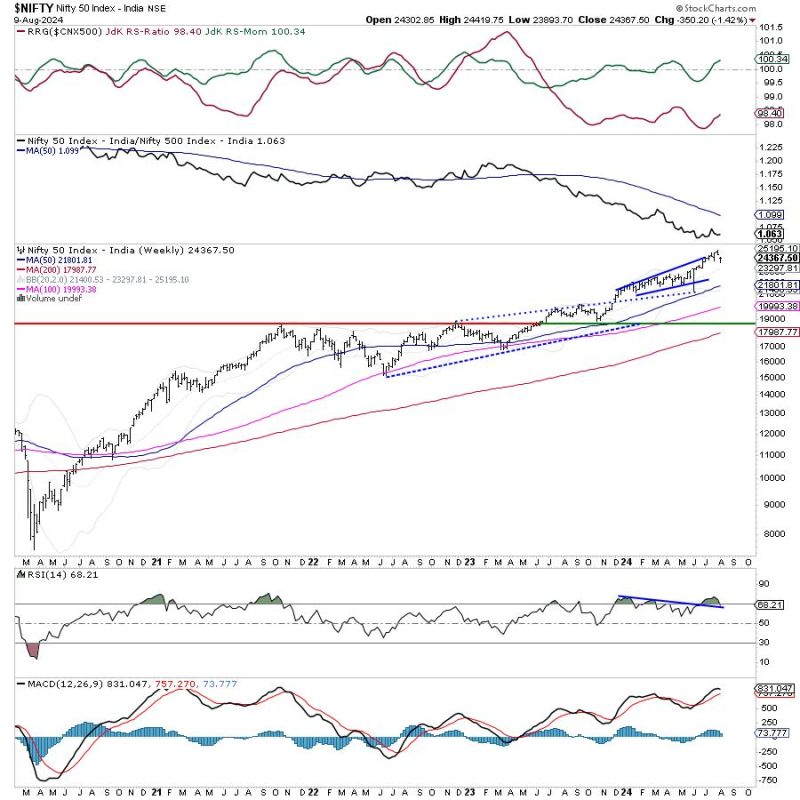

The article discusses the current market trends in the Nifty index and highlights the development of a defensive setup. It emphasizes the importance of understanding key levels for traders and investors. The analysis points out the support and resistance levels that are critical for decision making in the upcoming trading sessions.

The Nifty index has been exhibiting a tentative behavior in recent trading sessions as a defensive setup starts to develop. This shift in market sentiment is crucial for participants to be aware of, as it can impact their trading strategies and decisions.

One key aspect highlighted in the article is the significance of identifying key support and resistance levels. These levels play a vital role in determining potential entry and exit points for traders. By understanding these levels well, market participants can better navigate volatile market conditions and manage their risk effectively.

Technical analysis tools and indicators are also discussed in the article as essential components for market analysis. These tools can provide valuable insights into market trends, momentum, and potential turning points. Traders who use these tools in conjunction with an understanding of key levels are better equipped to make informed trading decisions.

Overall, staying informed about market developments, understanding key levels, and utilizing technical analysis tools are essential for navigating the current market environment. Traders and investors who are proactive in their market analysis and decision-making process will be better positioned to capitalize on opportunities and manage risks effectively in the weeks ahead.